The rout that started in emerging markets last month is now roiling stocks and currencies across Africa.

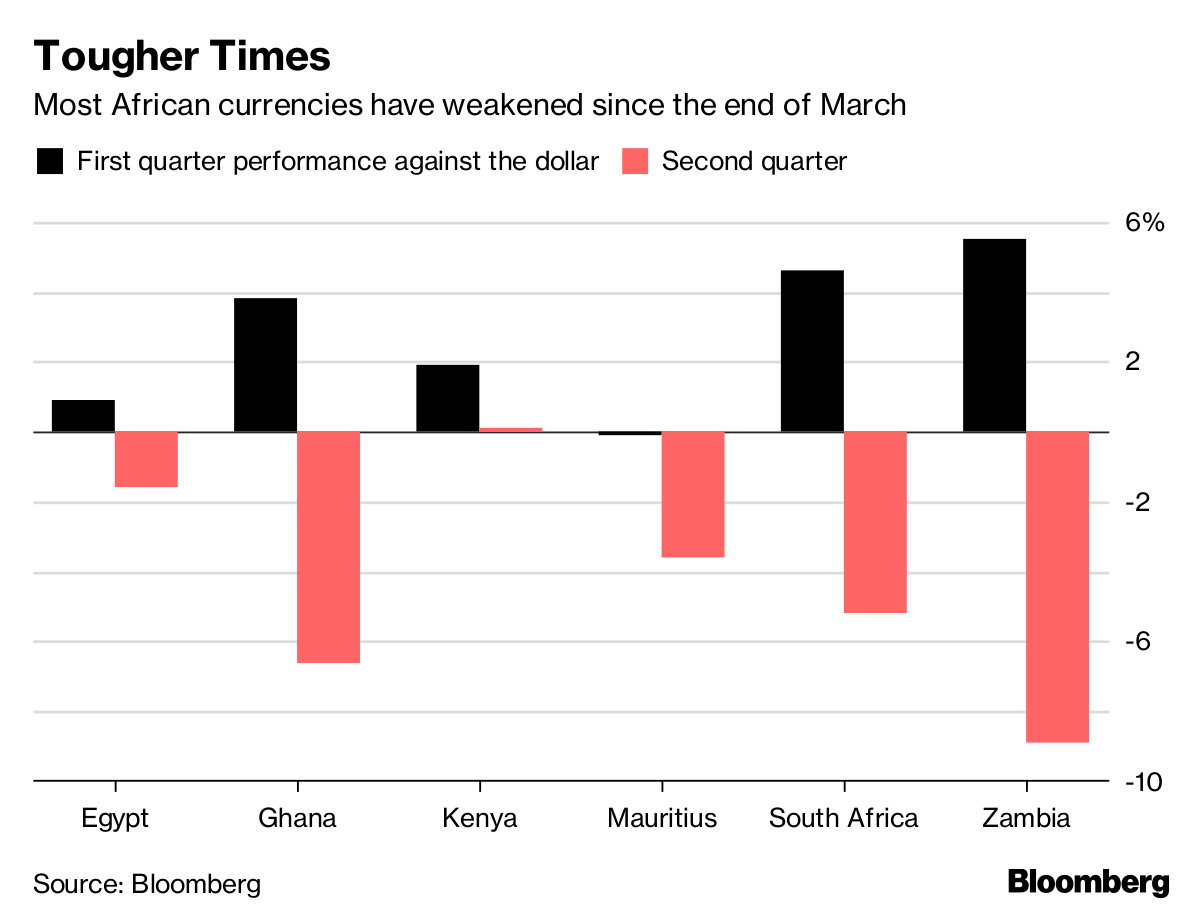

The pain’s visible in foreign-exchange markets. While South Africa’s rand was hit early on, other less-liquid currencies are also under pressure. Most have reversed or pared the gains against the dollar they posted in the first quarter.

Zambia’s kwacha, in particular, is struggling. It’s weakened 8.9 percent since the end of March, among the worst globally. While investors were previously attracted by the kwacha’s carry returns, they’re now exiting a country struggling with what the International Monetary Fund described as a debt problem.

Egypt, Ghana and Kenya are also showing strain. Egypt’s stocks, which had risen steadily since the pound was devalued in November 2016, have fallen more than 9 percent since late April. Ghanaian equities were world beaters in the first quarter, but have since slipped along with the cedi, as have Kenya’s shilling and stocks.

Tougher TimesMost African currencies have weakened since the end of March

Source: Bloomberg

.chart-js { display: none; }

Nigeria is another case in point. Despite Brent crude’s 15 percent rise in 2018 to about $80 a barrel, the OPEC member’s currency is under pressure for the first time this year. The naira has fallen to its weakest level since November on the black market and foreign reserves halted their continuous rise since September. The West African country’s main stock index is near a five-month low as international funds reduce their exposure, according to Exotix Capital.

#lazy-img-328056613:before{padding-top:56.25%;} LISTEN TO ARTICLE 1:24 Share Share on Facebook Post to Twitter Send as an Email Print

LISTEN TO ARTICLE 1:24 Share Share on Facebook Post to Twitter Send as an Email Print

No comments:

Post a Comment