Even after the recent sell-off in US stocks, the market still looks expensive by many metrics, including the Warren Buffett Indicator now telling you not to bet on America... well, at least not to bet solely on America. Even currently overpriced, the US stocks account for just nearly half of the world's total stock market value. American investors should consider shopping overseas.

Additionally, it is widely believed that markets are efficient, meaning that information is readily reflected in stock prices. Hence, investors may have to find the oasis in the desert.

For both reasons above, I recommend long-term investors turn to the less liquid OTC market, where many high-quality foreign businesses are listed.

The OTC market often earns its shady reputation of exposing investors to the risk of fraud through many Pink Sheet companies due to lack of transparency. But these stereotypical penny stocks are not the only companies trading OTC.

Big foreign brands like Samsung (OTC:SSNLF), Nestle (OTCPK:NSRGY), BMW (OTCPK:BMWYY), or Nintendo (OTCPK:NTDOY) should sound familiar to many Americans. While you would not see any of those popular names on NYSE or any other major exchange in the US, the OTC market does offer the access for US investors to own a piece of those foreign businesses that are large-scale, well-established and hopefully wonderful.

RisksAccording to Investopedia, around 15,000 companies trade OTC in the States, and they can roughly divide into the following four categories:

Companies that fail to meet the listing requirements for the major stock exchanges; Companies that are de-listed from the major exchanges, often for lack of financial information; Companies that fall off after their stock drops under $1.00; Foreign companies that do not want to meet the filing and listing requirements of the major U.S. exchanges.Obviously, large foreign companies, such as Samsung, would belong to the 4th category and should not have the issues described in the other three categories.

In order for any stock to list on a major American exchange, the company it represents must meet all the typical NYSE or Nasdaq SEC disclosure requirements. This is still the case for foreign companies even when they already meet the requirements of their home country. Therefore, getting "officially" listed here is often considered expensive and unnecessary.

For the instance of Nestle, costs associated with hiring a legal team specializing in U.S. market regulations would be quite large. However, since the company already meets the regulatory listings of the SIX Swiss Exchange, the Euronext, the Bombay Stock Exchange and the National Stock Exchange of India Limited, Nestle simply chooses not to officially list in the U.S. Instead, US investors have the option to buy its ADRs over-the-counter.

The risk associated with lack of regulation is almost nonexistent for those foreign companies trading OTC in the US, as investors have access to and should carefully examine their public information (e.g., financial statements, annual reports) per requirements of their primary listing exchanges. I always go through all relevant info on the company's website (especially the "Investors" section) and research based on the primarily-listed stock ticker through sources like Morningstar, GuruFocus, Investing.com (all these websites provide analysis, data, research on overseas-listed stocks) before buying their corresponding ADRs on the OTC market.

However, OTC stocks lack liquidity in general and are often thinly traded, which can make them volatile with wide bid-ask spreads.

My Top Quality Investing PicksI was trying to screen out top quality stocks based on the following rigorous criteria:

Return on invested capital and on equity both above 15% each year for the past 10 years; Return on assets above 10% each year for the past 10 years; Earning-before-tax margin above 10% each year for the past 10 years; Positive free cash flow each year for the past 10 years.To my surprise, I landed on a dozen companies - more than I could have imagined, as a majority of Corporate America cannot even get close to meeting all of the above criteria, including from tech giant Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Microsoft (MSFT) to iconic American brands Walmart (WMT) and Coca-Cola (KO).

I admire the business fundamentals of all the below companies, while the current valuation for each stock varies and investors should decide their own entry point based on respective time horizons.

Rightmove PLC

Created in 2000 as a joint venture between some property agents, Rightmove is now the UK's No. 1 online real estate portal and property website. The company is primarily listed on the London Stock Exchange under ticker RMV, while US investors can get access to its shares OTC under tickers OTCPK:RTMVY and OTCPK:RTMVF.

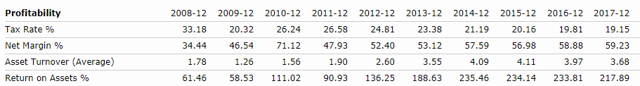

Rightmove has achieved tremendous successes in growing its business and delivering value to shareholders for the past decade. It also recently tops my stock quality ranking with a skyrocketing return on assets currently at over 200% (see below).

Source: Morningstar; data as of 6/21/2018.

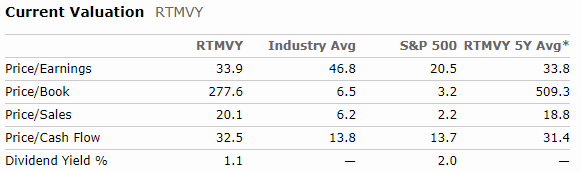

RTMVY (the ADR of the stock) is currently valued in line with its historical levels in terms of P/E and slightly overvalued in terms of P/S and P/CF (see below). Consider the high return on capital, I recommend long-term investors initiate a position and accumulate more shares over time.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Hargreaves Lansdown PLC

Founded in 1981 by its two founders who had initially traded from a bedroom, Hargreaves Lansdown now claims to be the UK's No. 1 investment platform for private investors. The company is primarily listed on the London Stock Exchange under ticker HL while US investors can get access to its shares OTC under tickers OTCPK:HRGLY and OTCPK:HRGLF.

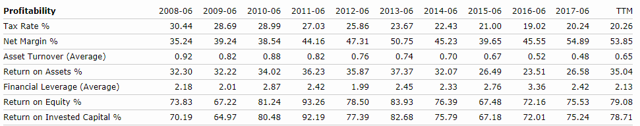

The revenue growth has slowed down in recent years, but this cannot stop the company from earning an astonishingly high return on capital as it did for the past 10 years (see below).

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

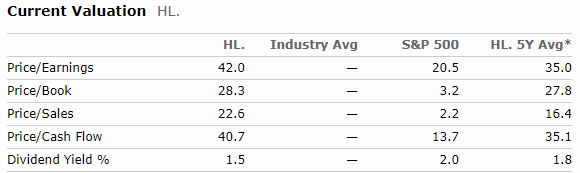

According to Morningstar, HRGLY (the ADR of the stock) looks overpriced based on all metrics (see below). Investors may want to wait for a pull-back to initiate a position.

Source: Morningstar; data as of 6/21/2018.

Swedish Match

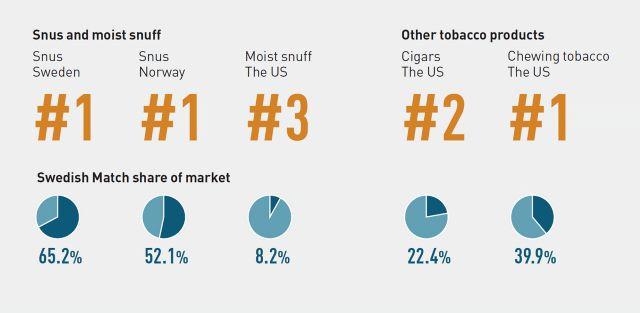

With the vision of "a world without cigarettes" (which I personally like a lot), Swedish Match is the market leader in snus in Sweden and Norway and chewing tobacco in the US.

Source: www.swedishmatch.com; data as of 6/21/2018.

The company is primarily listed on the Stockholm Stock Exchange under ticker SWMA, while US investors can get access to its shares OTC under tickers OTCPK:SWMAY and OTCPK:SWMAF.

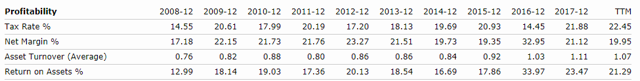

The company has remarkably increased its returns on assets from 12.99% to 21.29% (see below) over the past 10 years, demonstrating increasing efficiencies of allocating capitals.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

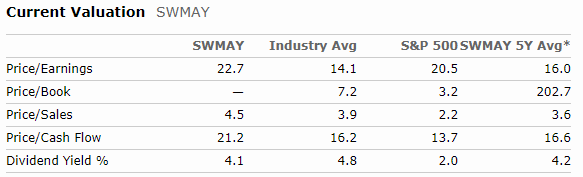

SWMAY (the ADR of the stock) is currently overvalued in terms of P/E, P/S, and P/CF compared with their historical averages (see below). Hence, investors may want to wait for a pull-back to initiate a position.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Domino's Pizza Group PLC

Domino's Pizza Group PLC is a UK-based pizza delivery company, holding the exclusive franchise rights (through two Master Franchise Agreements in place with Domino's Pizza International Franchising Inc.) for the Domino's brand in the United Kingdom, Republic of Ireland, Switzerland, Liechtenstein, and Luxembourg. In addition, the company has associate investments in Germany, Iceland, Norway, and Sweden.

Source: Domino's Pizza Group PLC 2016 Annual Report.

The company is primarily listed on the London Stock Exchange under ticker DOM, while US investors can get access to its shares OTC under tickers OTCPK:DPUKY and OTC:DPUKF.

Earlier this year, I wrote this article, praising the company's capital-light franchise model in a recession-proof market segment. For the past 10 years, Domino's UK master franchise has achieved consistently high ROIC (see below), uninterrupted strong growth, and a track record of paying back its owners.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

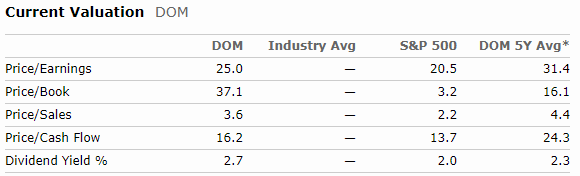

DOM (the primarily-listed share) is looking slightly cheap and traded at discount to its historical average in terms of P/E, P/S, and P/CF at the moment (see below). I suggest investors initiate a position and accumulate more shares over time.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Novozymes AS

Founded in 2000 as a spinout from pharmaceutical company Novo Nordisk (NVO), Novozymes is now the world leader in industrial enzymes with almost 50% market share globally.

Novozymes' B shares (the A share, which carries 10 times as many votes as the B share, is held by the Novo Nordisk Foundation and not publicly traded) are listed on NASDAQ Copenhagen under ticker NZYMB, while US investors can get access to its stocks OTC under tickers OTCPK:NVZMY and OTCPK:NVZMF.

For the past decade, the management has done an excellent job of expanding the margins from all levels (i.e., gross margin, operating margin and pre-tax margin). In the meantime, the annual free cash flow tripled (from 738 million DKK in 2008 to 2,371 million in 2017).

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

NVZMY (the ADR of the stock) appears to trade at discount in terms of P/E and P/CF compared to their historical averages and slightly overvalued in terms of P/S (see below). To avoid missing out, I recommend investors with long-term time horizons initiate a position and accumulate more shares over time. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Industria De Diseno Textil SA

As the biggest fashion group in the world, Industria De Diseno Textil SA (or Inditex) operates over 7,200 stores in 93 markets worldwide. The company's flagship store is Zara, but it also owns the chains Zara Home, Massimo Dutti, Bershka, Oysho, Pull and Bear, Stradivarius and Uterq眉e. The majority of its stores are corporate-owned, while franchises are mainly conceded in countries where corporate properties cannot be foreign-owned.

The company is primarily listed on the Madrid Stock Exchange under ticker ITX, while US investors can get access to its shares OTC under tickers OTCPK:IDEXF and OTCPK:IDEXY.

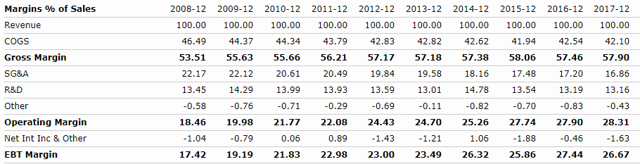

Inditex operates a unique business model: instead of committing a large percentage of production for the next fashion season, the company commits a small amount and uses customer feedback and an efficient production network to replenish stores with new and different products weekly. As a result, the company keeps customers coming back often, earning consistently high returns on capital (e.g., 25%+ ROE, 25%+ ROIC, 15%+ ROA, each year for the past 10 years), demonstrating strong and durable competitive advantages (see below).

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

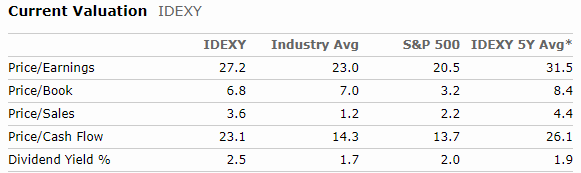

At the moment, IDEXY (the ADR of the stock) looks cheap in terms of P/E, P/S and P/CF compared to their historical averages (see below). I think IDEXY is a buy here.

Source: Morningstar; data as of 6/21/2018.

Pandora AS

Founded in 1982 by a Danish couple, Pandora has become the world's third-largest jewelry company in terms of sales, after Cartier and Tiffany (TIF), and is the world's largest player in the affordable jewelry market segment.

The company is primarily listed on the Copenhagen Stock Exchange under ticker PNDORA, while US investors can get access to its shares OTC under tickers OTCPK:PNDZF, OTCPK:PNDZY and OTCPK:PANDY.

Pandora builds its moat through strong branding and economies of scale, and as a result, has earned high returns on capital over the past decade. Even during the time when the silver price spiked in 2011/2012, pressuring the margins, the company managed to generate over 20% returns on equity and invested capital (see below).

Pandora shares fell nearly 80% in 2011 after a shift in focus to higher-end designs alienated core customers, but performance has recovered after a return to the more affordable mass market. The management is able to achieve a healthy net margin of 25% and asset turnover of 1.4.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

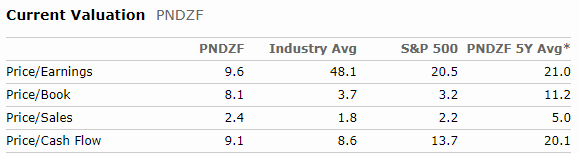

According to Morningstar, the OTC share is currently traded at a deep discount to its historical average in terms of P/E, P/S, and P/CF (see below). At this level, Pandora is a buy.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Unilever Indonesia

Established in1933, Unilever Indonesia, a publicly-traded subsidiary of the Unilever Group (UN) (UL), has now grown to become one of Indonesia's leading Fast Moving Consumer Goods companies. The company has been accompanying Indonesian societies through world-renowned brands, including Pepsodent, Lux, Lifebuoy, Dove, Sunsilk, Clear, Rexona, Vaseline, Rinso, Molto, Sunlight, Wall's, Blue Band, Royco, Bango and more.

The company is primarily listed on the Jakarta Stock Exchange under ticker UNVR, while US investors can get access to its shares OTC under tickers OTCPK:UNLRY and OTCPK:UNLRF.

The management has been able to maintain the EBT margin above 20% for the past decade, while the asset turnover has been trending down. Even so, the return on assets stands well above our 10% threshold (see below).

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

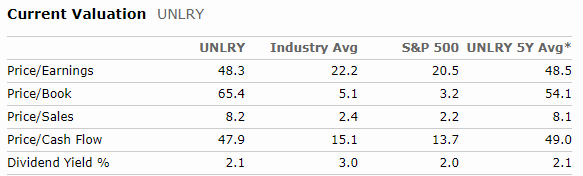

UNLRY (the ADR of the stock) is currently traded in line with its historical valuation level in terms of P/E, P/S, and P/CF (see below). Considering the high quality of the business, I recommend long-term investors start a position in UNLRY and accumulate more shares over time.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Hermes International SA

This is the stock topping my quality ranking earlier this year. Established in 1837, Hermes is the designer, manufacturer, and marketer of high fashion luxury goods, with specialization in leather, lifestyle accessories, home furnishings, perfumery, jewelry, watches and ready-to-wear. The company is primarily listed on the Euronext Paris under ticker RMS, while US investors can get access to its shares OTC under tickers OTCPK:HESAY and OTCPK:HESAF.

The business targets at the ultra-rich, and is therefore recession-proof on the downside. With ongoing consumption upgrade in China, Hermes is positioned well for tremendous growth opportunities ahead.

The inherent uniqueness and scarcity reflected by the Hermes brand help the company build a wide moat through high customer loyalty. The returns on capital and margins at Hermes are not so sexy but quite stable (see below).

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

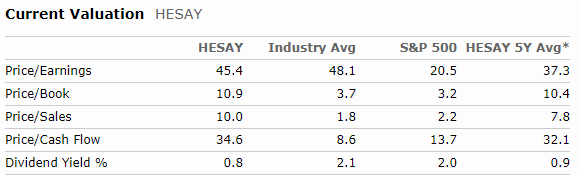

HESAY (the ADR of the stock) is currently looking expensive in terms of its P/E, P/S, P/CF compared to historical averages (see below). Investors may want to look for a pull-back before buying HESAY. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Roche Holding AG

Founded in Europe in 1896, Roche was first known for producing various vitamin preparations and derivatives. Since then, Roche has grown into one of the world's leading healthcare companies with focuses on pharmaceuticals and diagnostics.

The company is primarily listed on the SIX Swiss Exchange under ticker ROG, while US investors can get access to its shares OTC under tickers OTCQX:RHHBY and OTCQX:RHHBF.

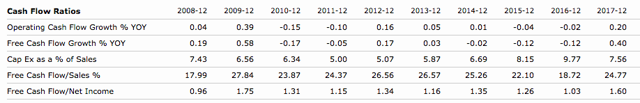

Roche is one of the very few foreign companies increasing their dividend every year for over 30 years. This track record is likely to continue, given the current free cash flow dividend coverage of around 50% and a stable free cash flow margin at Roche (see below).

Source: Morningstar; data as of 6/21/2018.

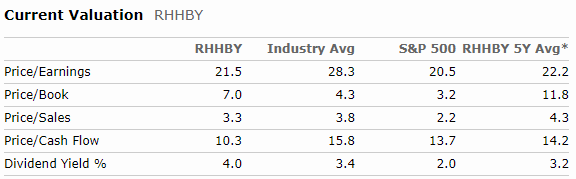

RHHBY (the ADR of the stock) appears to be undervalued in terms of P/E, P/S, and P/CF compared to their historical averages (see below). The stock is a buy at this level in my view.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Fuchs Petrolub SE

Founded in 1931 and headquartered in Germany, Fuchs Petrolub SE is the world's largest independent manufacturer of lubricants and related specialty products.

The company is primarily listed on the Frankfurt Stock Exchange under ticker FPE, while US investors can get access to its shares OTC under tickers OTCPK:FUPBY, OTC:FUPEY, and OTCPK:FUPEF.

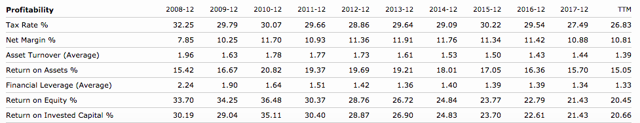

The management has shown great capital allocation skills with the focus on Fuchs Value Added (i.e., EBIT - cost of capital), which is the central KPI. The return on invested capital stood above 20% over the past 10 years (see below), although it has been trending down during the recent years.

Source: Morningstar; data as of 6/21/2018.

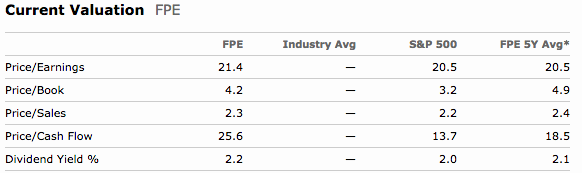

At the moment, FPE (the primarily-listed share) is trading at a premium to its historical average in terms of P/E and P/CF but at a discount in terms of P/S (see below). Therefore, investors may want to look for a pull-back on this stock.

Source: Morningstar; data as of 6/21/2018.

SummaryInvestors should not ignore the OTC market, where many high-quality foreign stocks are traded. Those who believe in Quality Investing may want to follow my above picks, all of which have demonstrated consistently high returns on capital and margins. Even for value-sensitive investors, I believe that Rightmove, Domino's UK, Roche, Novozymes, Unilever Indonesia, Inditex, and Pandora are great candidates being wonderful businesses at fair prices to diversify US-concentrated portfolios. For the other companies mentioned above (i.e., Swedish Match, Hargreaves Lansdown, Fuchs Petrolub, Herme), investors may want to be a little patient, waiting for a more attractive entry point.

If you have any thought regarding the OTC market or any of the companies mentioned here, feel free to comment below.

Disclosure: I am/we are long RTMVY.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment