Corporate America is set to shower investors with a record surge of cash.

Between buybacks, dividends, and merger activities, companies are poised to plow $2.5 trillion into the stock market this year, according to UBS Group AG. The buying spree is equivalent to 10 percent of the S&P 500’s market capitalization, easily outstripping prior records.

The projection helps revive the bull case for stocks, which have flat-lined so far in 2018 amid trade tensions and higher bond yields. And it’s no wonder U.S. equity leadership has remained so narrow: the corporate flow comes largely from momentum shares such as technology companies, which have enjoyed the largest gains over the past year.

#lazy-img-328326705:before{padding-top:61.24999999999999%;}Source: UBS Group AG“The backdrop supports our overweights in healthcare and tech, as well as continued outperformance of growth and momentum strategies given such massive "flow" to growth firms/funds and investors’ reinvesting the proceeds into stocks with strong fundamental momentum,” UBS’s equity strategists, headed by Keith Parker, wrote in a Monday note.

Top 10 Dividend Stocks To Watch Right Now: Microchip Technology Incorporated(MCHP)

Advisors' Opinion:- [By VantagePoint]

Microchip Technology Incorporated (NASDAQ: MCHP) had a clear crossover to the upside on May 3, when the blue predicted moving average crossed above the black simple 10-day moving average. Since then the stock is up 17 percent, while the gray candle predicting Thursday's range shows continued upside. As long as the two lines don't crossover, look for this uptrend to continue.

- [By Lisa Levin] Companies Reporting Before The Bell Dean Foods Company (NYSE: DF) is projected to report quarterly earnings at $0.11 per share on revenue of $1.85 billion. Discovery, Inc. (NASDAQ: DISCA) is expected to report quarterly earnings at $0.44 per share on revenue of $1.99 billion. Jacobs Engineering Group Inc. (NYSE: JEC) is estimated to report quarterly earnings at $0.89 per share on revenue of $3.63 billion. Henry Schein, Inc. (NASDAQ: HSIC) is expected to report quarterly earnings at $0.92 per share on revenue of $3.17 billion. Gartner, Inc. (NYSE: IT) is projected to report quarterly earnings at $0.57 per share on revenue of $926.18 million. The AES Corporation (NYSE: AES) is estimated to report quarterly earnings at $0.24 per share on revenue of $2.98 billion. Expeditors International of Washington, Inc. (NASDAQ: EXPD) is projected to report quarterly earnings at $0.64 per share on revenue of $1.71 billion. US Foods Holding Corp. (NYSE: USFD) is expected to report quarterly earnings at $0.32 per share on revenue of $5.98 billion. DISH Network Corporation (NASDAQ: DISH) is expected to report quarterly earnings at $0.7 per share on revenue of $3.50 billion. Zebra Technologies Corporation (NASDAQ: ZBRA) is estimated to report quarterly earnings at $2.06 per share on revenue of $936.98 million. Camping World Holdings, Inc. (NYSE: CWH) is expected to report quarterly earnings at $0.42 per share on revenue of $1.06 billion. Perrigo Company plc (NYSE: PRGO) is projected to report quarterly earnings at $1.14 per share on revenue of $1.21 billion. Petróleo Brasileiro S.A. - Petrobras (NYSE: PBR) is estimated to report quarterly earnings at $0.28 per share on revenue of $23.80 billion. JD.com, Inc. (NYSE: JD) is projected to report quarterly earnings at $0.18 per share on revenue of $15.65 billion. Valeant Pharmaceuticals International, Inc. (NYSE: VRX) is projected to report quarterly earnings at $0.6 per share o

- [By Stephan Byrd]

Microchip Technology (NASDAQ:MCHP) had its price objective increased by Morgan Stanley from $96.00 to $97.00 in a research report report published on Wednesday morning. The brokerage currently has an equal weight rating on the semiconductor company’s stock.

- [By Shane Hupp]

Get a free copy of the Zacks research report on Microchip Technology (MCHP)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Top 10 Dividend Stocks To Watch Right Now: UMH Properties Inc.(UMH)

Advisors' Opinion:- [By Joseph Griffin]

WINTON GROUP Ltd bought a new stake in UMH PROPERTIES/SH SH (NYSE:UMH) during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 86,705 shares of the real estate investment trust’s stock, valued at approximately $1,163,000. WINTON GROUP Ltd owned about 0.24% of UMH PROPERTIES/SH SH as of its most recent SEC filing.

- [By Lisa Levin]

Wednesday afternoon, the real estate shares surged 0.56 percent. Meanwhile, top gainers in the sector included Armada Hoffler Properties, Inc. (NYSE: AHH), up 3 percent, and UMH Properties, Inc. (NYSE: UMH) up 3 percent.

Top 10 Dividend Stocks To Watch Right Now: S&P GSCI(GD)

Advisors' Opinion:- [By ]

General Dynamics (NYSE: GD) is diversified across the Aerospace & Defense sector with 25% of sales in information technology, followed by aerospace orders (24%), marine systems (23%), combat systems (16%), and mission systems (12%). The acquisition of CSRA makes it one of the largest IT contractors to the U.S. government.

- [By Joseph Griffin]

Riverhead Capital Management LLC increased its holdings in shares of General Dynamics (NYSE:GD) by 223.5% in the 1st quarter, according to its most recent filing with the SEC. The fund owned 12,055 shares of the aerospace company’s stock after purchasing an additional 8,328 shares during the period. Riverhead Capital Management LLC’s holdings in General Dynamics were worth $2,663,000 at the end of the most recent reporting period.

- [By ]

In addition to increasing the dividend, Action Alerts PLUS holding Raytheon announced in late March that under the Department of Defense's DARPA program, it was developing technology that could control swarms of both air-based, and ground-based drone vehicles that might be launched using a "drag and drop" visual interface. My price target: $245.

General Dynamics (GD)This is one firm where we have already seen cash flows and margins improving. GD is also another defense name that increased their dividend in March. Think the Navy gets some love in the 2018 federal budget that earmarked $654 billion for the Pentagon? Me too. Know who runs the Virginia class submarine program? General Dynamics. In fact, the Navy just awarded a $696 million modification to that program for 2019.

- [By ]

Cramer and Moreno also looked at General Dynamics (GD) which peaked in early March, before starting a downtrend until Tuesday. Last week, General Dynamics fell to the lower end of its channel, but then it bounced right to the high end, and Wednesday it firmly broke out above the high end of this channel. The stochastic oscillator, which is a powerful momentum indicator is making a bullish crossover, and based on today's move, Moreno thinks General Dynamics can return to its old highs at $230.

- [By Max Byerly]

General Dynamics (NYSE:GD) had its price objective reduced by stock analysts at Royal Bank of Canada from $232.00 to $12.39 in a research report issued on Friday, The Fly reports. The brokerage currently has an “outperform” rating on the aerospace company’s stock. Royal Bank of Canada’s price target indicates a potential downside of 93.65% from the stock’s current price.

Top 10 Dividend Stocks To Watch Right Now: Nordson Corporation(NDSN)

Advisors' Opinion:- [By Motley Fool Staff]

Nordson (NASDAQ:NDSN) Q2 2018 Earnings Conference CallMay. 22, 2018 8:30 a.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:Operator

- [By Ethan Ryder]

Victory Capital Management Inc. grew its stake in shares of Nordson Co. (NASDAQ:NDSN) by 10.6% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 16,868 shares of the industrial products company’s stock after purchasing an additional 1,612 shares during the period. Victory Capital Management Inc.’s holdings in Nordson were worth $2,300,000 as of its most recent SEC filing.

- [By Stephan Byrd]

Get a free copy of the Zacks research report on Nordson (NDSN)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Garrett Baldwin]

Markets have been under pressure once again by the U.S. Federal Reserve. Inflation levels are going through the roof… but the people in charge of managing it have been lying to Americans for years. Now, it's time to get even.�Money Morning�Liquidity Specialist Lee Adler has the perfect way to make a lot of money when no one is looking.�Read it here.

The Top Stock Market Stories for Monday Markets are cheering news that the supposed trade war between the United States and China is "on hold," according to U.S. Treasury Secretary Steven Mnuchin. Mnuchin and U.S. President Donald Trump's top economic advisor, Larry Kudlow, announced that both nations have reached an agreement, one that established a framework to help address ongoing trade imbalances between the two countries. The prices of crude oil is in focus after Venezuelan President Nicolas Maduro won reelection over the weekend. The election featured a very low turnout and a very large outcry that the vote was rigged. Maduro has a 75% disapproval rating and has been the face of the OPEC member's widespread mismanagement and economic collapse. Prior to the election, a member of the Trump administration said that the United States would not recognize the authenticity of the election. The United States is considering additional sanctions on Venezuela. Today is a major day for mergers and acquisition activity. Today, Blackstone Group LP�(NYSE: BX) announced plans to purchase U.S. hotel operator LaSalle Hotel Properties (NYSE: LHO) for a whopping $3.7 billion. The deal comes at a time that the travel industry is experiencing one of the best periods in a decade. If you're looking for a way to make money ahead of Memorial Day weekend, we show you how here. Four Stocks to Watch Today: GOOGL, GE, MBFI, FITB Alphabet Inc. (Nasdaq: GOOGL) is under pressure this morning after a harsh piece aired last night on "60 Minutes." The segment discussed the organization's power and influence. It also featured inter - [By Steve Symington]

Nordson Corporation�(NASDAQ:NDSN)�announced solid fiscal second-quarter 2018 results on Monday after the market closed, including an expected decline in organic volume that was more than offset by acquisitive growth.

Top 10 Dividend Stocks To Watch Right Now: Regal Beloit Corporation(RBC)

Advisors' Opinion:- [By Ethan Ryder]

Generac (NYSE: GNRC) and Regal Beloit (NYSE:RBC) are both mid-cap computer and technology companies, but which is the better stock? We will compare the two companies based on the strength of their institutional ownership, risk, analyst recommendations, valuation, profitability, earnings and dividends.

- [By Lisa Levin] Companies Reporting Before The Bell Dean Foods Company (NYSE: DF) is projected to report quarterly earnings at $0.11 per share on revenue of $1.85 billion. Discovery, Inc. (NASDAQ: DISCA) is expected to report quarterly earnings at $0.44 per share on revenue of $1.99 billion. Jacobs Engineering Group Inc. (NYSE: JEC) is estimated to report quarterly earnings at $0.89 per share on revenue of $3.63 billion. Henry Schein, Inc. (NASDAQ: HSIC) is expected to report quarterly earnings at $0.92 per share on revenue of $3.17 billion. Gartner, Inc. (NYSE: IT) is projected to report quarterly earnings at $0.57 per share on revenue of $926.18 million. The AES Corporation (NYSE: AES) is estimated to report quarterly earnings at $0.24 per share on revenue of $2.98 billion. Expeditors International of Washington, Inc. (NASDAQ: EXPD) is projected to report quarterly earnings at $0.64 per share on revenue of $1.71 billion. US Foods Holding Corp. (NYSE: USFD) is expected to report quarterly earnings at $0.32 per share on revenue of $5.98 billion. DISH Network Corporation (NASDAQ: DISH) is expected to report quarterly earnings at $0.7 per share on revenue of $3.50 billion. Zebra Technologies Corporation (NASDAQ: ZBRA) is estimated to report quarterly earnings at $2.06 per share on revenue of $936.98 million. Camping World Holdings, Inc. (NYSE: CWH) is expected to report quarterly earnings at $0.42 per share on revenue of $1.06 billion. Perrigo Company plc (NYSE: PRGO) is projected to report quarterly earnings at $1.14 per share on revenue of $1.21 billion. Petróleo Brasileiro S.A. - Petrobras (NYSE: PBR) is estimated to report quarterly earnings at $0.28 per share on revenue of $23.80 billion. JD.com, Inc. (NYSE: JD) is projected to report quarterly earnings at $0.18 per share on revenue of $15.65 billion. Valeant Pharmaceuticals International, Inc. (NYSE: VRX) is projected to report quarterly earnings at $0.6 per share o

- [By Lisa Levin]

Companies Reporting After The Bell Hertz Global Holdings, Inc. (NYSE: HTZ) is projected to post quarterly loss at $1.31 per share on revenue of $1.97 billion. International Flavors & Fragrances Inc. (NYSE: IFF) is estimated to post quarterly earnings at $1.59 per share on revenue of $909.36 million. Zillow Group, Inc. (NASDAQ: ZG) is expected to post quarterly earnings at $0.06 per share on revenue of $294.79 million. General Cable Corporation (NYSE: BGC) is estimated to post quarterly earnings at $0.15 per share on revenue of $980.61 million. Central Garden & Pet Company (NASDAQ: CENT) is expected to post quarterly earnings at $0.84 per share on revenue of $598.45 million. Cabot Corporation (NYSE: CBT) is estimated to post quarterly earnings at $1 per share on revenue of $746.42 million. Fabrinet (NYSE: FN) is expected to post quarterly earnings at $0.71 per share on revenue of $319.71 million. National General Holdings Corp. (NASDAQ: NGHC) is projected to post quarterly earnings at $0.55 per share on revenue of $1.08 billion. The Navigators Group, Inc. (NASDAQ: NAVG) is estimated to post quarterly earnings at $0.75 per share on revenue of $320.92 million. Diplomat Pharmacy, Inc. (NYSE: DPLO) is expected to post quarterly earnings at $0.22 per share on revenue of $1.29 billion. Trex Company, Inc. (NYSE: TREX) is projected to post quarterly earnings at $1.19 per share on revenue of $172.22 million. AMC Entertainment Holdings, Inc. (NYSE: AMC) is expected to post quarterly earnings at $0.09 per share on revenue of $1.35 billion. Envision Healthcare Corporation (NYSE: EVHC) is projected to post quarterly earnings at $0.64 per share on revenue of $2.02 billion. Regal Beloit Corporation (NYSE: RBC) is estimated to post quarterly earnings at $1.23 per share on revenue of $869.64 million. Amedisys, Inc. (NASDAQ: AMED) is projected to post quarterly earnings at $0.67 per share on revenue of $39 - [By Logan Wallace]

Foundry Partners LLC raised its holdings in Regal Beloit Corp (NYSE:RBC) by 2.5% during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 183,147 shares of the industrial products company’s stock after purchasing an additional 4,534 shares during the quarter. Foundry Partners LLC owned 0.42% of Regal Beloit worth $13,434,000 as of its most recent filing with the Securities and Exchange Commission.

Top 10 Dividend Stocks To Watch Right Now: ONEOK Inc.(OKE)

Advisors' Opinion:- [By Reuben Gregg Brewer]

Kinder Morgan, Inc. (NYSE:KMI) is one of the largest midstream companies in North America, and it has major dividend plans between 2018 and 2020. By the end of that period, it expects to increase its dividend from $0.50 per share per year (in 2017) to $1.25. That's huge dividend growth in a short period of time. But don't get too enamored by that news; the dividend will still be lower than it was before the midstream oil and gas company's 75% dividend cut in 2016. If you're looking for dividend income in the midstream space, take a look at longtime dividend payers ONEOK, Inc. (NYSE:OKE) and Magellan Midstream Partners, L.P. (NYSE:MMP) instead.� �

- [By Ethan Ryder]

ONEOK, Inc. (NYSE:OKE)’s share price reached a new 52-week high and low during mid-day trading on Thursday . The stock traded as low as $68.88 and last traded at $68.33, with a volume of 81549 shares changing hands. The stock had previously closed at $67.81.

- [By Max Byerly]

Westwood Holdings Group Inc. lowered its position in ONEOK, Inc. (NYSE:OKE) by 39.1% during the first quarter, according to its most recent filing with the SEC. The institutional investor owned 191,644 shares of the utilities provider’s stock after selling 123,100 shares during the period. Westwood Holdings Group Inc.’s holdings in ONEOK were worth $10,908,000 at the end of the most recent quarter.

- [By Matthew DiLallo]

Several pipeline stocks have produced market-beating returns since their formation. Enterprise Products Partners (NYSE:EPD) and ONEOK (NYSE:OKE) stand out because they have turned a relatively small up-front investment into a massive windfall over the past two decades.

Top 10 Dividend Stocks To Watch Right Now: Cellcom Israel Ltd.(CEL)

Advisors' Opinion:- [By Stephan Byrd]

Partner Communications (NASDAQ: PTNR) and Cellcom Israel (NYSE:CEL) are both small-cap computer and technology companies, but which is the superior stock? We will compare the two companies based on the strength of their earnings, analyst recommendations, institutional ownership, risk, valuation, profitability and dividends.

- [By Ethan Ryder]

Millicom (OTCMKTS: MIICF) and Cellcom Israel (NYSE:CEL) are both computer and technology companies, but which is the better business? We will contrast the two businesses based on the strength of their risk, valuation, dividends, institutional ownership, analyst recommendations, earnings and profitability.

- [By Lisa Levin]

Thursday afternoon, the health care shares rose 1.79 percent. Meanwhile, top gainers in the sector included Partner Communications Company Ltd. (NASDAQ: PTNR), up 8 percent, and Cellcom Israel Ltd. (NYSE: CEL) up 7 percent.

- [By Lisa Levin]

Thursday afternoon, the telecommunication services shares surged 0.58 percent. Meanwhile, top gainers in the sector included Intelsat S.A. (NYSE: I), up 5 percent, and Cellcom Israel Ltd. (NYSE: CEL) up 2.5 percent.

- [By Lisa Levin]

Check out these big penny stock gainers and losers

Losers Natural Health Trends Corp (NASDAQ: NHTC) fell 7.8 percent to $19.80 in pre-market trading after rising 1.46 percent on Friday. Endocyte, Inc. (NASDAQ: ECYT) shares fell 6.6 percent to $11.41 in pre-market trading after climbing 4.18 percent on Friday. Quorum Health Corporation (NYSE: QHC) shares fell 6.2 percent to $5.15 in pre-market trading after tumbling 11.45 percent on Friday. Arcadia Biosciences, Inc. (NASDAQ: RKDA) fell 6.1 percent to $7.31 in pre-market trading after declining 3.35 percent on Friday. Boston Scientific Corporation (NYSE: BSX) fell 5.6 percent to $28.30 in pre-market trading. Evofem Biosciences, Inc. (NASDAQ: EVFM) fell 5.3 percent to $6.06 in pre-market trading after gaining 2.73 percent on Friday. Xerox Corporation (NYSE: XRX) shares fell 5.2 percent to $28.60 in pre-market trading. Xerox terminated its transaction agreement with Fujifilm and entered into a new agreement with Carl Icahn and Darwin Deason. JP Morgan downgraded Xerox from Overweight to Neutral. Cellcom Israel Ltd. (NYSE: CEL) fell 5.2 percent to $7.02 in pre-market trading. Cellcom is expected to release Q1 results on May 30, 2018. Perrigo Company plc (NYSE: PRGO) fell 4.5 percent to $74 in pre-market trading. Nabriva Therapeutics plc (NASDAQ: NBRV) shares fell 4 percent to $4.66 in pre-market trading

Top 10 Dividend Stocks To Watch Right Now: America First Tax Exempt Investors L.P.(ATAX)

Advisors' Opinion:- [By Shane Hupp]

Get a free copy of the Zacks research report on America First Multifamily Investors (ATAX)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Max Byerly]

Get a free copy of the Zacks research report on America First Multifamily Investors (ATAX)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Shane Hupp]

Shares of America First Tax Exempt Investors, L.P. (NASDAQ:ATAX) hit a new 52-week high and low during mid-day trading on Monday . The company traded as low as $6.47 and last traded at $6.43, with a volume of 54800 shares changing hands. The stock had previously closed at $6.43.

Top 10 Dividend Stocks To Watch Right Now: Scana Corporation(SCG)

Advisors' Opinion:- [By Reuben Gregg Brewer]

While all of this is going on, Dominion has also announced plans to buy financially struggling peer SCANA Corp.�(NYSE:SCG). This utility got into trouble when it canceled a nuclear construction project midstream after its contractor declared bankruptcy. Regulators, customers, and politicians have been less than pleased, with demands for rate and dividend cuts (a dividend cut was just announced).

- [By Chris Lange]

The S&P 500 stock posting the largest daily percentage loss ahead of the close Tuesday was SCANA Corp. (NYSE: SCG) which traded down roughly 5% at $41.13. The stock��s 52-week range is $37.10 to $71.28. Volume was 3.5 million, compared with the daily average of 3 million shares.

- [By Lisa Levin] Companies Reporting Before The Bell General Motors Company (NYSE: GM) is projected to report quarterly earnings at $1.24 per share on revenue of $34.66 billion. Bristol-Myers Squibb Company (NYSE: BMY) is estimated to report quarterly earnings at $0.85 per share on revenue of $5.24 billion. United Parcel Service, Inc. (NYSE: UPS) is expected to report quarterly earnings at $1.55 per share on revenue of $16.44 billion. Time Warner Inc. (NYSE: TWX) is projected to report quarterly earnings at $1.74 per share on revenue of $7.91 billion. ConocoPhillips (NYSE: COP) is expected to report quarterly earnings at $0.74 per share on revenue of $8.81 billion. PepsiCo, Inc. (NYSE: PEP) is expected to report quarterly earnings at $0.93 per share on revenue of $12.4 billion. American Airlines Group Inc. (NASDAQ: AAL) is estimated to report quarterly earnings at $0.72 per share on revenue of $10.42 billion. Southwest Airlines Co (NYSE: LUV) is expected to report quarterly earnings at $0.74 per share on revenue of $5.01 billion. Fiat Chrysler Automobiles N.V. (NYSE: FCAU) is estimated to report quarterly earnings at $0.8 per share on revenue of $34.52 billion. Union Pacific Corporation (NYSE: UNP) is projected to report quarterly earnings at $1.66 per share on revenue of $5.38 billion. D.R. Horton, Inc. (NYSE: DHI) is expected to report quarterly earnings at $0.85 per share on revenue of $3.76 billion. The Hershey Company (NYSE: HSY) is estimated to report quarterly earnings at $1.4 per share on revenue of $1.94 billion. Praxair, Inc. (NYSE: PX) is expected to report quarterly earnings at $1.56 per share on revenue of $2.94 billion. Altria Group, Inc. (NYSE: MO) is projected to report quarterly earnings at $0.92 per share on revenue of $4.63 billion. Shire plc (NASDAQ: SHPG) is estimated to report quarterly earnings at $3.54 per share on revenue of $3.72 billion. Oshkosh Corporation (NYSE: OSK) is projected to report quarter

- [By Shane Hupp]

These are some of the media stories that may have impacted Accern Sentiment’s analysis:

Get NetEase alerts: Top 50 most innovative Chinese companies (ecns.cn) Keep an eye on Active stock of Yesterday�� NetEase, Inc. (NTES) (stockmarketstop.com) Varying Stocks: DowDuPont Inc., (NYSE: DWDP), NetEase, Inc., (NASDAQ: NTES) (globalexportlines.com) Be Ready for Active Stock: NetEase, Inc. (NTES) (bitcoinpriceupdate.review) Tossing Stocks: NetEase, Inc., (NYSE: NTES), SCANA Corporation, (NYSE: SCG) (nysetradingnews.com)Shares of NTES opened at $267.10 on Friday. The stock has a market capitalization of $34.83 billion, a price-to-earnings ratio of 21.52, a price-to-earnings-growth ratio of 2.26 and a beta of 0.80. NetEase has a fifty-two week low of $222.32 and a fifty-two week high of $377.64.

- [By Ethan Ryder]

Get a free copy of the Zacks research report on SCANA (SCG)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Top 10 Dividend Stocks To Watch Right Now: Laboratory Corporation of America Holdings(LH)

Advisors' Opinion:- [By Shane Hupp]

Triangle Securities Wealth Management lifted its stake in Laboratory Corp. of America Holdings (NYSE:LH) by 34.5% in the second quarter, HoldingsChannel.com reports. The fund owned 2,339 shares of the medical research company’s stock after purchasing an additional 600 shares during the period. Triangle Securities Wealth Management’s holdings in Laboratory Corp. of America were worth $420,000 as of its most recent filing with the Securities & Exchange Commission.

- [By Joseph Griffin]

Envestnet Asset Management Inc. reduced its position in shares of LabCorp (NYSE:LH) by 45.1% during the first quarter, HoldingsChannel.com reports. The fund owned 19,179 shares of the medical research company’s stock after selling 15,727 shares during the quarter. Envestnet Asset Management Inc.’s holdings in LabCorp were worth $3,116,000 at the end of the most recent reporting period.

- [By Shane Hupp]

These are some of the headlines that may have impacted Accern’s analysis:

Get LabCorp alerts: $2.92 Earnings Per Share Expected for LabCorp (LH) This Quarter (americanbankingnews.com) Global Contract Research Organization Market 2018 Pioneers by 2023: Parexel, LabCorp (Covance), PRA, PPD … (theexpertconsulting.com) OmniSeq and LabCorp Launch OmniSeq Advance? Assay (nasdaq.com) LabCorp’s latest collaboration aims to accelerate personalized, genomic medicine (bizjournals.com) Can Laboratory Corporation of America Holdings (NYSE:LH) Continue To Outperform Its Industry? (finance.yahoo.com)LH has been the topic of several analyst reports. Barclays lifted their target price on shares of LabCorp from $195.00 to $210.00 and gave the stock an “overweight” rating in a research note on Monday, February 26th. They noted that the move was a valuation call. Zacks Investment Research raised shares of LabCorp from a “hold” rating to a “buy” rating and set a $190.00 target price on the stock in a research note on Friday, February 9th. Jefferies Group reaffirmed a “hold” rating and issued a $176.00 target price on shares of LabCorp in a research note on Tuesday, March 6th. ValuEngine raised shares of LabCorp from a “hold” rating to a “buy” rating in a research note on Friday, February 2nd. Finally, Morgan Stanley lifted their target price on shares of LabCorp from $182.00 to $192.00 and gave the stock an “overweight” rating in a research note on Wednesday, February 28th. Five research analysts have rated the stock with a hold rating, twelve have given a buy rating and two have assigned a strong buy rating to the stock. LabCorp has an average rating of “Buy” and an average target price of $191.06.

- [By Max Byerly]

MUFG Americas Holdings Corp trimmed its stake in LabCorp (NYSE:LH) by 55.0% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 10,683 shares of the medical research company’s stock after selling 13,073 shares during the quarter. MUFG Americas Holdings Corp’s holdings in LabCorp were worth $1,728,000 as of its most recent filing with the Securities & Exchange Commission.

'Peak earnings' fears are overblown, says market strategist Art Hogan 16 Hours Ago | 04:24 Disclaimer

'Peak earnings' fears are overblown, says market strategist Art Hogan 16 Hours Ago | 04:24 Disclaimer

Moneywise Inc. cut its holdings in Schwab U.S. Mid-Cap ETF (NYSEARCA:SCHM) by 3.9% during the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 204,021 shares of the company’s stock after selling 8,198 shares during the quarter. Schwab U.S. Mid-Cap ETF makes up approximately 9.6% of Moneywise Inc.’s holdings, making the stock its 4th largest holding. Moneywise Inc.’s holdings in Schwab U.S. Mid-Cap ETF were worth $11,199,000 at the end of the most recent quarter.

Moneywise Inc. cut its holdings in Schwab U.S. Mid-Cap ETF (NYSEARCA:SCHM) by 3.9% during the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 204,021 shares of the company’s stock after selling 8,198 shares during the quarter. Schwab U.S. Mid-Cap ETF makes up approximately 9.6% of Moneywise Inc.’s holdings, making the stock its 4th largest holding. Moneywise Inc.’s holdings in Schwab U.S. Mid-Cap ETF were worth $11,199,000 at the end of the most recent quarter.  James Investment Research Inc. boosted its position in shares of ConocoPhillips (NYSE:COP) by 8.5% in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 319,545 shares of the energy producer’s stock after acquiring an additional 25,087 shares during the period. ConocoPhillips accounts for 0.9% of James Investment Research Inc.’s holdings, making the stock its 23rd biggest position. James Investment Research Inc.’s holdings in ConocoPhillips were worth $22,246,000 at the end of the most recent quarter.

James Investment Research Inc. boosted its position in shares of ConocoPhillips (NYSE:COP) by 8.5% in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 319,545 shares of the energy producer’s stock after acquiring an additional 25,087 shares during the period. ConocoPhillips accounts for 0.9% of James Investment Research Inc.’s holdings, making the stock its 23rd biggest position. James Investment Research Inc.’s holdings in ConocoPhillips were worth $22,246,000 at the end of the most recent quarter.  Cubist Systematic Strategies LLC purchased a new stake in Stoneridge, Inc. (NYSE:SRI) in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 7,757 shares of the auto parts company’s stock, valued at approximately $214,000.

Cubist Systematic Strategies LLC purchased a new stake in Stoneridge, Inc. (NYSE:SRI) in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 7,757 shares of the auto parts company’s stock, valued at approximately $214,000.  Wall Street analysts expect that Gaia Inc (NASDAQ:GAIA) will announce earnings per share (EPS) of ($0.42) for the current fiscal quarter, Zacks Investment Research reports. Two analysts have issued estimates for Gaia’s earnings. Gaia also reported earnings of ($0.42) per share during the same quarter last year. The business is scheduled to issue its next quarterly earnings results on Monday, August 6th.

Wall Street analysts expect that Gaia Inc (NASDAQ:GAIA) will announce earnings per share (EPS) of ($0.42) for the current fiscal quarter, Zacks Investment Research reports. Two analysts have issued estimates for Gaia’s earnings. Gaia also reported earnings of ($0.42) per share during the same quarter last year. The business is scheduled to issue its next quarterly earnings results on Monday, August 6th.

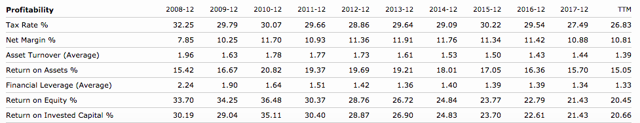

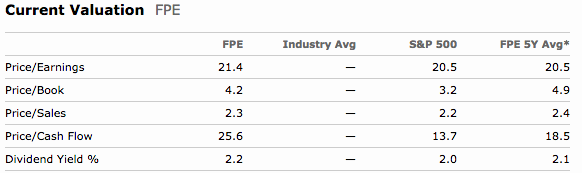

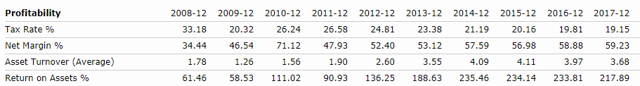

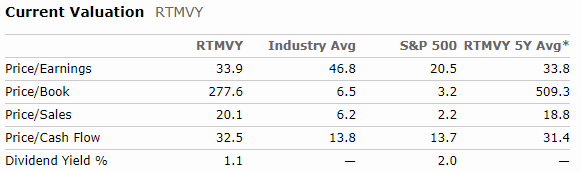

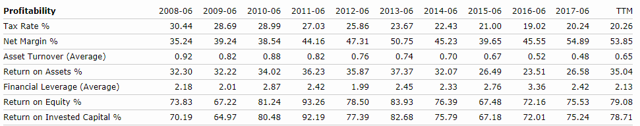

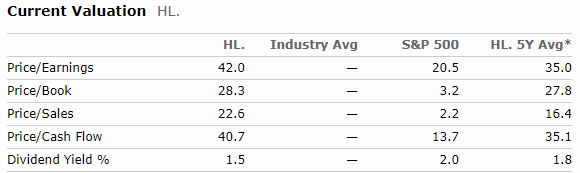

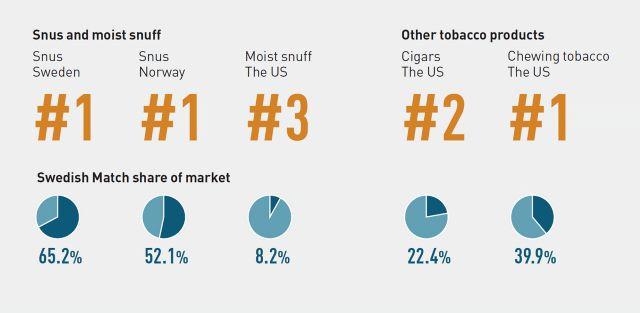

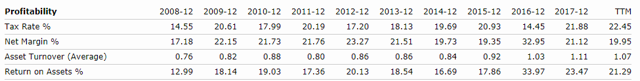

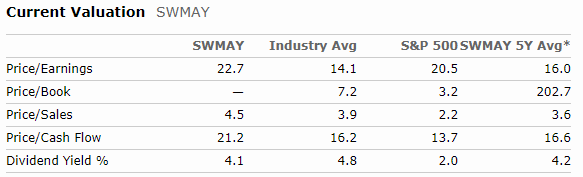

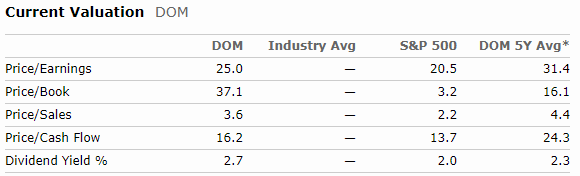

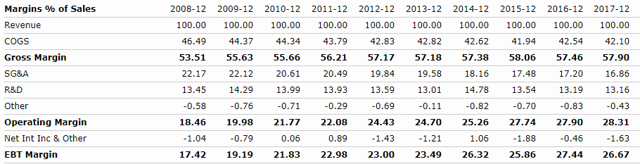

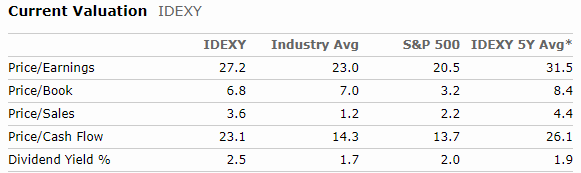

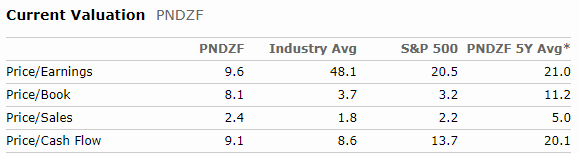

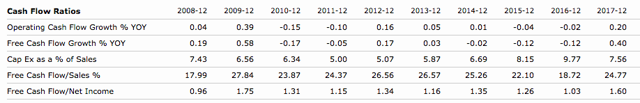

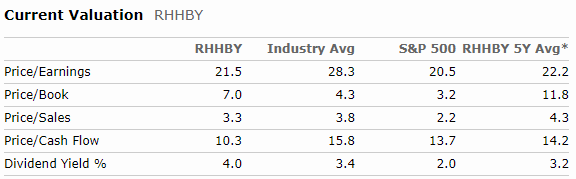

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

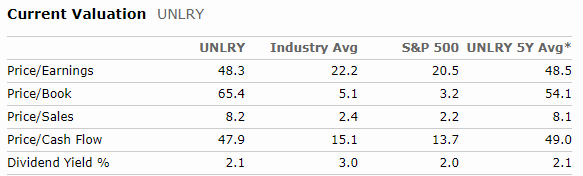

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

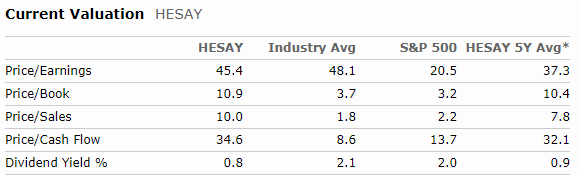

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.