Ross Stores (ROST) beat estimates in the first quarter for the 8th consecutive time. Investors still sold the stock despite higher sales and strong earnings. The problem is rising costs and relatively low same store sales going forward.

Source: Ross Stores

Source: Ross Stores

Before I go any further, I think it is important to highlight what makes Ross Stores special. Especially if you are not that familiar with the company.

The one thing that distinguishes Ross Stores from other clothing retailers is the fact that Ross Stores works with a discount model. The company sells branded and non-branded clothes at a 40-60% discount thanks to its large network of vendors and manufacturers which allows the company to buy production overruns, canceled orders and discounts at the end of a season.

The main customers are middle-income families who visit the stores up to 3 times each month.

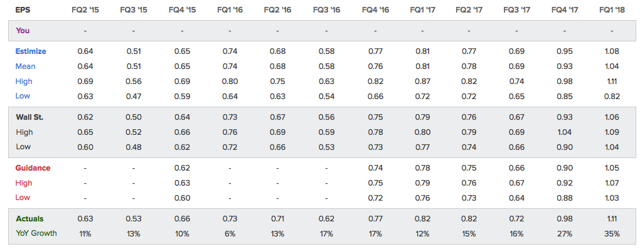

Double Digit GrowthThe company just released first quarter earnings. Total EPS came in at $1.11 with a $0.17 boost due to the recent tax cuts. EPS growth including the tax cuts comes in at 35% while earnings growth excluding the tax benefits falls to 14.6%. If we only look at the lower number ex. taxes, we see that the company has been growing its EPS at roughly 14-15% since 2016. This was also the time when the US consumer came back after a rough year in 2015. Note that Ross Stores was still able to do rather well during 2015, which is due to its business model and fact that the company is still expanding rapidly as I will discuss further in this article.

Source: Estimize

Source: Estimize

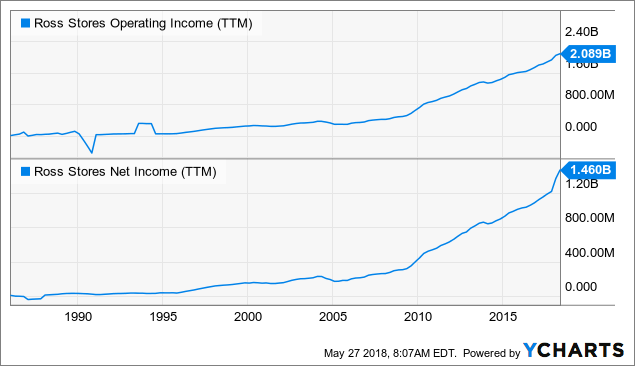

The big picture shows that both operating income and net income are in a massive uptrend since 2009. Net income accelerated to $1.46 billion on a TTM basis which is obviously fueled by tax cuts. Operating income on the other hand is very close to $2.1 billion.

ROST Operating Income (NYSE:TTM) data by YCharts

ROST Operating Income (NYSE:TTM) data by YCharts

Total sales in the first quarter increased a massive 9% to $3.6 billion. Total comparable store sales increased 3%. Both growth rates are on a year-on-year basis. Moreover, unfavorable weather caused comparable store sales to be one percent point lower than previously expected.

Total consolidated inventories increased 19%, which was due to higher packaway levels. Packaway inventories contain the products bought from production overruns and canceled orders as I discussed at the start of this article. That said, the 19% increase was due to favorable opportunities in the marketplace to buy clothes at even bigger discounts.

Moreover, total cost of goods sold improved 20 basis points as a result of higher merchandise margins and lower distribution costs stemming from favorable timing of packaway-related expenses.

That being said, input costs are also rising.

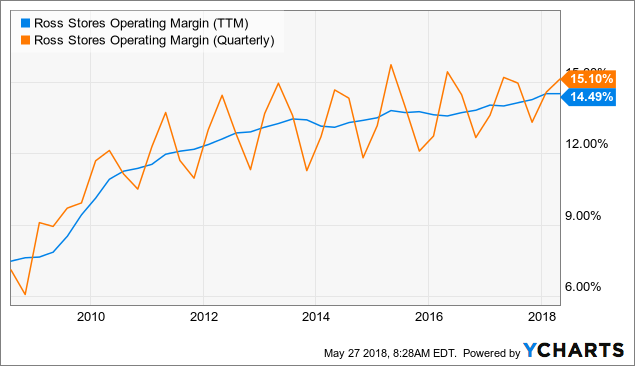

Margins Are Under PressureOperating margins came in at 15.1%. This is down slightly compared to last year. All improvements in merchandise gross margins and favorable packaway-related expenses were offset by higher freight costs and wage-related investments.

Just like every single labor and transportation intensive company, Ross Stores is feeling the pressure from rising input costs. This hits the company very hard given that the consumer is feeling the pressure from higher inflation (gas, housing, food, etc.) and the fact that operating costs are increasing.

Even though the year-on-year change of operating margins is slightly negative, we still see that the trend is up on a TTM, even if this trend is rapidly weakening.

ROST Operating Margin (TTM) data by YCharts

ROST Operating Margin (TTM) data by YCharts

2018 will see the opening of another 100 stores: 75 of these will be Ross Stores while the remaining 25 will be dd's Discounts stores. On top of that the company will either close or relocate 10 older stores.

Same store sales in the second quarter are expected to slow a bit and to come in between 1%-2%. Total sales are expected to grow 5-6%. Also note than 30 of the 100 new store openings will take place in the second quarter.

Operating margins are expected to come in between 13.3% and 13.5%. This is down more than one full point compared to last year's 14.9%. This decline is entirely caused by unfavorable timing of packaway-related costs and higher wage and benefit investments.

Moreover, the company mentions a competitive retail landscape and robust multi-year sales comparisons over the next few quarters.

Game PlanRoss Stores is a very interesting company. Their business model provides them with the opportunity to compete in one of the toughest business environments while still having the second highest profit margins among US stock listed apparel companies (9.60%). Moreover, the company is slightly less cyclical given their lower prices.

Personally, I think that Ross Stores is a must have stock to track the US consumer if the retail industry warrants a long position.

However, we are currently in an environment of accelerating input costs, which is both putting pressure on the consumer and on the company's profitability.

Even though Ross Stores keeps growing at a healthy rate, there is no denying that the pressure on margins is hurting the bottom line. Investors sold the stock after the earnings on Friday (05/25/18), which pushes the YTD performance down to almost -4%.

The stock's valuation is also nothing to get too excited about with a price earnings ratio close to industry average at 20 and a PEG ratio of 2.06.

I am not at all saying this company is bad. I love the business model and will buy this stock without hesitation when I want to trade the apparel industry.

However, the current environment is just not good enough for me to get excited about this stock. I am staying on the sidelines until I find an interesting entry.

Stay tuned!

Thank you for reading my article. Please let me know what you think of my thesis. Your input is highly appreciated!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

LISTEN TO ARTICLE 1:24 Share Share on Facebook Post to Twitter Send as an Email Print

LISTEN TO ARTICLE 1:24 Share Share on Facebook Post to Twitter Send as an Email Print