Facebook Inc. (NASDAQ: FB) was worried about this, and so was traditional media. Bogus news sites had more traffic than legitimate ones late in the election cycle, according to a survey done by BuzzFeed:

A BuzzFeed News analysis found that top fake election news stories generated more total engagement on Facebook than top election stories from 19 major news outlets combined.

The sites examined were among the most traditionally trusted news sites in the world:

To examine the performance of election content from mainstream sites, we created a list that included the websites of the New York Times, Washington Post, NBC News, USA Today, Politico, CNN, Wall Street Journal, CBS News, ABC News, New York Daily News, New York Post, BuzzFeed, Los Angeles Times, NPR, The Guardian, Vox, Business Insider, Huffington Post, and Fox News. We then searched for their top-performing election content in the same three-month segments as above.

It is frightening to examine the extent to which false stories did well, and the fact that many came from virtually unknown sources:

Top 10 Performing Stocks To Own Right Now: Eagle Materials Inc(EXP)

Advisors' Opinion:- [By Shane Hupp]

Get a free copy of the Zacks research report on Eagle Materials (EXP)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Lisa Levin]

Eagle Materials Inc (NYSE: EXP) is projected to report quarterly earnings at $1.08 per share on revenue of $306.04 million.

AZZ Inc. (NYSE: AZZ) is estimated to report quarterly earnings at $0.44 per share on revenue of $231.53 million.

- [By Stephan Byrd]

Eagle Materials (NYSE:EXP) – Analysts at Northcoast Research issued their Q1 2019 earnings per share (EPS) estimates for shares of Eagle Materials in a research note issued to investors on Thursday, May 17th. Northcoast Research analyst K. Hocevar anticipates that the construction company will post earnings of $1.53 per share for the quarter. Northcoast Research also issued estimates for Eagle Materials’ Q2 2019 earnings at $1.80 EPS, Q3 2019 earnings at $1.70 EPS, Q4 2019 earnings at $1.17 EPS and FY2020 earnings at $7.40 EPS.

Top 10 Performing Stocks To Own Right Now: Tyson Foods Inc.(TSN)

Advisors' Opinion:- [By Joseph Griffin]

US Bancorp DE raised its position in shares of Tyson Foods, Inc. (NYSE:TSN) by 3.7% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 50,012 shares of the company’s stock after acquiring an additional 1,799 shares during the period. US Bancorp DE’s holdings in Tyson Foods were worth $3,661,000 at the end of the most recent reporting period.

- [By Max Byerly]

Media headlines about Tyson Foods (NYSE:TSN) have been trending somewhat positive this week, according to Accern Sentiment Analysis. The research group rates the sentiment of news coverage by monitoring more than 20 million news and blog sources in real time. Accern ranks coverage of public companies on a scale of negative one to positive one, with scores nearest to one being the most favorable. Tyson Foods earned a media sentiment score of 0.19 on Accern’s scale. Accern also assigned headlines about the company an impact score of 46.975937339582 out of 100, indicating that recent news coverage is somewhat unlikely to have an effect on the company’s share price in the next several days.

- [By ]

Tyson Foods (TSN) CEO Tom Hayes wasn't kidding when he told TheStreet he wanted to make another big acquisition soon.

But the argument could be made that Wall Street wasn't expecting his latest food purchase. On Tuesday, Tyson Foods said it will spend $850 million to buy the poultry rendering and blending assets of American Proteins, Inc. and AMPRO Products, Inc.

- [By Shane Hupp]

HL Financial Services LLC purchased a new position in shares of Tyson Foods (NYSE:TSN) during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 61,568 shares of the company’s stock, valued at approximately $4,506,000.

Top 10 Performing Stocks To Own Right Now: Pinnacle Foods, Inc.(PF)

Advisors' Opinion:- [By Jeremy Bowman]

Shares of�Pinnacle Foods Inc.�(NYSE:PF) were moving higher in April after the packaged-foods company became a target of activist investor Jana Partners. As a result the stock finished the month up 12%, according to data from S&P Global Market Intelligence.�

- [By Logan Wallace]

Pinnacle Foods (NYSE:PF) – Research analysts at Jefferies Group dropped their Q2 2018 EPS estimates for Pinnacle Foods in a research report issued on Tuesday, May 8th. Jefferies Group analyst A. Jagdale now forecasts that the company will post earnings per share of $0.56 for the quarter, down from their prior forecast of $0.58. Jefferies Group currently has a “Buy” rating and a $72.00 target price on the stock. Jefferies Group also issued estimates for Pinnacle Foods’ Q1 2019 earnings at $0.62 EPS, Q2 2019 earnings at $0.62 EPS, Q3 2019 earnings at $0.76 EPS, Q4 2019 earnings at $1.15 EPS, FY2019 earnings at $3.16 EPS and FY2020 earnings at $3.44 EPS.

- [By Lisa Levin] Gainers AGM Group Holdings Inc. (NASDAQ: AGMH) shares climbed 30.3 percent to $11.05 after climbing 34.60 percent on Thursday. Limelight Networks, Inc. (NASDAQ: LLNW) jumped 21.2 percent to $4.9699 following a first-quarter earnings beat. The company also raised its fiscal 2018 estimates. Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC) shares climbed 18.8 percent to $7.89 after reporting strong Q1 earnings. Farmers Capital Bank Corp (NASDAQ: FFKT) gained 15.4 percent to $48.75. WesBanco Inc (NASDAQ: WSBC) announced an agreement and plan of merger with Farmers Capital Bank Corporation. TransUnion (NYSE: TRU) climbed 10.2 percent to $66.76 after the company posted upbeat Q1 results and issued a strong forecast for the second quarter. TransUnion announced plans to acquire Callcredit. Myomo, Inc. (NYSE: MYO) shares gained 9.2 percent to $3.9299 after rising 8.11 percent on Thursday. Pinnacle Foods Inc (NYSE: PF) gained 8.8 percent to $60.04 after a 13-D filing from Jana Partners showed an increased stake in the comapny, from 1.42 million shares at the end of last quarter to 10.83 million shares, or a 9.3-percent stake. Associated Banc-Corp (NYSE: ASB) shares climbed 8.8 percent to $26.70 following upbeat Q1 earnings. OFG Bancorp (NYSE: OFG) gained 8.5 percent to $12.80 after reporting Q1 results. Cleveland-Cliffs Inc. (NYSE: CLF) climbed 7.5 percent to $7.73 following Q1 results. Seaspan Corporation (NYSE: SSW) shares climbed 6.7 percent to $7.50. Deutsche Bank upgraded Seaspan from Hold to Buy. General Electric Company (NYSE: GE) shares rose 4.6 percent to $14.63 after the company reported better-than-expected earnings for its first quarter. Ionis Pharmaceuticals, Inc. (NASDAQ: IONS) rose 4.3 percent to $47.80. Biogen and Ionis have expanded their strategic collaboration to develop drug candidates for a broad range of neurological diseases.

Check out these big penny stock gainers and losers

Top 10 Performing Stocks To Own Right Now: OraSure Technologies, Inc.(OSUR)

Advisors' Opinion:- [By Shane Hupp]

Get a free copy of the Zacks research report on OraSure Technologies (OSUR)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Lisa Levin]

Losers Heat Biologics, Inc. (NASDAQ: HTBX) shares tumbled 48.59 percent to close at $1.275 on Thursday after the company priced its $18,000,000 public offering. InVivo Therapeutics Holdings Corp. (NASDAQ: NVIV) fell 38.77 percent to close at $8.26 on Thursday. Check-Cap Ltd. (NASDAQ: CHEK) shares tumbled 27.43 percent to close at $8.81. Achaogen, Inc. (NASDAQ: AKAO) dropped 24.76 percent to close at $11.06 in reaction to a disappointing update from an FDA AdCom panel. The FDA panel voted favorably for the company's Plazcomicin for treatment of adults with complicated urinary tract infections, but also voted against the therapy to be used as a treatment for bloodstream infections. Anika Therapeutics, Inc. (NASDAQ: ANIK) shares declined 24.68 percent to close at $34.80 after the company posted downbeat quarterly results. LSC Communications, Inc. (NASDAQ: LKSD) shares fell 24.22 percent to close at $12.64 following wider-than-expected Q1 loss. Cardinal Health, Inc. (NYSE: CAH) fell 21.42 percent to close at $50.80 following downbeat quarterly profit. Horizon Global Corporation (NYSE: HZN) dropped 20.42 percent to close at $6.00 following downbeat quarterly earnings. Hornbeck Offshore Services, Inc. (NYSE: HOS) slipped 20.11 percent to close at $2.90 following wider-than-expected Q1 loss. Esperion Therapeutics, Inc. (NASDAQ: ESPR) fell 19.28 percent to close at $36.93. Esperion Therapeutics stock lost roughly a third of its value Wednesday after the company reported mixed Phase III results for its leading drug candidate, bempedoic acid. JP Morgan downgraded Esperion Therapeutics from Neutral to Underweight. Laredo Petroleum, Inc. (NYSE: LPI) declined 17.77 percent to close at $8.98 after the company reported weaker-than-expected Q1 earnings. The Habit Restaurants, Inc. (NASDAQ: HABT) dipped 16.1 percent to close at $8.60 after the company reported downbeat quarterly results. Arcadia Biosciences, Inc. (N - [By Joseph Griffin]

OraSure Technologies (NASDAQ:OSUR) has earned a consensus recommendation of “Hold” from the seven brokerages that are covering the firm, MarketBeat Ratings reports. Four investment analysts have rated the stock with a hold recommendation and two have assigned a buy recommendation to the company. The average twelve-month price objective among brokers that have covered the stock in the last year is $20.00.

Top 10 Performing Stocks To Own Right Now: Primo Water Corporation(PRMW)

Advisors' Opinion:- [By Logan Wallace]

Get a free copy of the Zacks research report on Primo Water (PRMW)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Jon C. Ogg]

Primo Water Corp. (NASDAQ: PRMW) was started with an Outperform rating at William Blair.�BMO Capital Markets maintained its Market Perform rating but the price target was raised to $16 from $15.

- [By Logan Wallace]

Primo Water (NASDAQ:PRMW) had its price objective hoisted by analysts at BMO Capital Markets from $15.00 to $16.00 in a research note issued on Thursday. The firm currently has a “market perform” rating on the stock. BMO Capital Markets’ price target points to a potential upside of 0.88% from the company’s current price.

- [By Andy Pai]

Primo Water Corporation (Nasdaq: PRMW) appears to be the most undervalued stock in the fund. The company has a blended upside of 31.1 percent relative to its current trading price.

- [By Logan Wallace]

Primo Water (NASDAQ:PRMW) CFO David J. Mills sold 5,934 shares of the business’s stock in a transaction dated Monday, May 7th. The stock was sold at an average price of $13.50, for a total value of $80,109.00. Following the completion of the transaction, the chief financial officer now owns 79,624 shares in the company, valued at approximately $1,074,924. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link.

Top 10 Performing Stocks To Own Right Now: PHH Corp(PHH)

Advisors' Opinion:- [By Stephan Byrd]

Media headlines about PHH (NYSE:PHH) have been trending somewhat positive recently, Accern Sentiment reports. Accern rates the sentiment of media coverage by monitoring more than twenty million blog and news sources. Accern ranks coverage of publicly-traded companies on a scale of -1 to 1, with scores nearest to one being the most favorable. PHH earned a news impact score of 0.17 on Accern’s scale. Accern also gave news coverage about the credit services provider an impact score of 45.9794154743809 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the company’s share price in the next few days.

- [By Max Byerly]

Orix (NYSE: IX) and PHH (NYSE:PHH) are both finance companies, but which is the better investment? We will contrast the two businesses based on the strength of their valuation, analyst recommendations, profitability, earnings, dividends, risk and institutional ownership.

- [By Logan Wallace]

PHH (NYSE: PHH) and Orix (NYSE:IX) are both finance companies, but which is the better business? We will contrast the two companies based on the strength of their risk, institutional ownership, earnings, dividends, valuation, analyst recommendations and profitability.

- [By Max Byerly]

PHH (NYSE:PHH) is scheduled to be announcing its earnings results after the market closes on Tuesday, May 8th. Analysts expect the company to announce earnings of ($0.94) per share for the quarter.

Top 10 Performing Stocks To Own Right Now: Extreme Networks Inc.(EXTR)

Advisors' Opinion:- [By Logan Wallace]

Extreme Networks (NASDAQ:EXTR) Director Edward H. Kennedy bought 50,000 shares of Extreme Networks stock in a transaction on Friday, May 18th. The shares were bought at an average price of $9.03 per share, for a total transaction of $451,500.00. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website.

- [By Lisa Levin]

Extreme Networks, Inc. (NASDAQ: EXTR) shares dropped 24 percent to $8.95 after the company reported downbeat earnings for its third quarter and issued weak Q4 guidance.

- [By Anders Bylund]

Shares of Extreme Networks (NASDAQ:EXTR) fell 19.5% in May 2018, according to data from S&P Global Market Intelligence. The maker of data center networking equipment delivered a weak third-quarter report and modest guidance on May 8. The stock crashed hard�and hasn't recovered yet.

- [By Lisa Levin]

Some of the stocks that may grab investor focus today are:

Wall Street expects Booking Holdings Inc. (NASDAQ: BKNG) to post quarterly earnings at $10.67 per share on revenue of $2.87 billion after the closing bell. Booking Holdings shares gained 0.99 percent to $2,183.00 in after-hours trading. Tripadvisor Inc (NASDAQ: TRIP) reported stronger-than-expected results for its first quarter on Tuesday. Tripadvisor shares climbed 20.55 percent to $46.75 in the after-hours trading session. Analysts are expecting Anheuser-Busch InBev SA/NV (NYSE: BUD) to have earned $0.89 per share on revenue of $13.06 billion in the latest quarter. Anheuser-Busch will release earnings before the markets open. Anheuser-Busch shares gained 0.77 percent to $99.00 in after-hours trading. Extreme Networks, Inc (NASDAQ: EXTR) reported downbeat earnings for its third quarter and issued weak Q4 guidance. Extreme Networks shares fell 28.51 percent to $8.40 in the after-hours trading session. Before the opening bell, Ameren Corporation (NYSE: AEE) is projected to report quarterly earnings at $0.57 per share on revenue of $1.55 billion. Ameren shares dropped 2.78 percent to close at $56.91 on Tuesday.Find out what's going on in today's market and bring any questions you have to Benzinga's PreMarket Prep.

- [By Ethan Ryder]

Extreme Networks (NASDAQ:EXTR) insider Edward Meyercord acquired 20,000 shares of the stock in a transaction dated Monday, May 14th. The shares were bought at an average cost of $8.42 per share, with a total value of $168,400.00. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink.

- [By Anders Bylund]

Shares of network equipment maker Extreme Networks (NASDAQ:EXTR) are having a rough Wednesday. The stock opened 26.8% lower today, following last night's release of disappointing third-quarter results.

Top 10 Performing Stocks To Own Right Now: Meridian Interstate Bancorp Inc.(EBSB)

Advisors' Opinion:- [By Logan Wallace]

BidaskClub upgraded shares of Meridian Bancorp (NASDAQ:EBSB) from a hold rating to a buy rating in a research report sent to investors on Friday morning.

Top 10 Performing Stocks To Own Right Now: NetSol Technologies Inc.(NTWK)

Advisors' Opinion:- [By Ethan Ryder]

NetSol Technologies (NASDAQ:NTWK) CEO Najeeb Ghauri purchased 2,500 shares of the business’s stock in a transaction on Friday, May 25th. The shares were acquired at an average cost of $6.20 per share, with a total value of $15,500.00. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink.

- [By Lisa Levin] Gainers Precipio, Inc. (NASDAQ: PRPO) jumped 43.3 percent to $0.5447 after the micro-cap specialty diagnostics company reported preliminary first-quarter results. The company said its first quarter revenue rose 286 percent from the same quarter a year ago to $712,000. Galectin Therapeutics, Inc. (NASDAQ: GALT) gained 34.5 percent to $4.52 after the company announced it would proceed with Phase 3 development of GR-MD-02 for NASH Cirrhosis following the FDA meeting. Boxlight Corporation (NASDAQ: BOXL) shares rose 21.9 percent to $8.1063. Evolus, Inc. (NASDAQ: EOLS) shares surged 16 percent to $15.65. Myomo, Inc. (NYSE: MYO) shares jumped 15.5 percent to $3.6263 after the company disclosed that its application for Medicare codes received favorable preliminary decision. Tandem Diabetes Care, Inc. (NASDAQ: TNDM) rose 13.7 percent to $10.12. ProPhase Labs, Inc. (NASDAQ: PRPH) gained 13.7 percent to $4.6743. Acacia Communications, Inc. (NASDAQ: ACIA) shares gained 12.2 percent to $35.34 as optical sector is seeing strength following President Trump's announcement that he would work with China related to ZTE Corp. Tailored Brands, Inc. (NYSE: TLRD) shares rose 11.3 percent to $35.17. Jefferies upgraded Tailored Brands from Hold to Buy. Kona Grill, Inc. (NASDAQ: KONA) jumped 10.6 percent to $2.875. Federated National Holding Company (NASDAQ: FNHC) shares rose 10.6 percent to $20.29. Raymond James upgraded Federated National Holding from Outperform to Strong Buy. Renewable Energy Group, Inc. (NASDAQ: REGI) climbed 10.2 percent to $15.15. Renewable Energy will replace Synchronoss Technologies Inc. (NASDAQ: SNCR) in the S&P SmallCap 600 on Tuesday, May 15. Stein Mart, Inc. (NASDAQ: SMRT) shares climbed 10.1 percent to $3.16. Stein Mart is expected to release Q1 earnings on May 23. NXP Semiconductors N.V. (NASDAQ: NXPI) rose 9.7 percent to $108.60 after Bloomberg reported that the China’s Commerce Ministry has restar

- [By Logan Wallace]

Sapiens International (NASDAQ: SPNS) and NetSol Technologies (NASDAQ:NTWK) are both small-cap computer and technology companies, but which is the superior business? We will compare the two companies based on the strength of their analyst recommendations, profitability, valuation, institutional ownership, earnings, dividends and risk.

- [By Stephan Byrd]

TheStreet upgraded shares of NetSol Technologies (NASDAQ:NTWK) from a d+ rating to a c- rating in a research note published on Tuesday morning.

Separately, ValuEngine raised shares of NetSol Technologies from a hold rating to a buy rating in a research report on Thursday, May 17th.

- [By Stephan Byrd]

NetSol Technologies (NASDAQ:NTWK) CEO Najeeb Ghauri acquired 2,500 shares of NetSol Technologies stock in a transaction that occurred on Wednesday, May 30th. The stock was acquired at an average price of $6.50 per share, with a total value of $16,250.00. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link.

Top 10 Performing Stocks To Own Right Now: Laboratory Corporation of America Holdings(LH)

Advisors' Opinion:- [By Shane Hupp]

These are some of the headlines that may have impacted Accern’s analysis:

Get LabCorp alerts: $2.92 Earnings Per Share Expected for LabCorp (LH) This Quarter (americanbankingnews.com) Global Contract Research Organization Market 2018 Pioneers by 2023: Parexel, LabCorp (Covance), PRA, PPD … (theexpertconsulting.com) OmniSeq and LabCorp Launch OmniSeq Advance? Assay (nasdaq.com) LabCorp’s latest collaboration aims to accelerate personalized, genomic medicine (bizjournals.com) Can Laboratory Corporation of America Holdings (NYSE:LH) Continue To Outperform Its Industry? (finance.yahoo.com)LH has been the topic of several analyst reports. Barclays lifted their target price on shares of LabCorp from $195.00 to $210.00 and gave the stock an “overweight” rating in a research note on Monday, February 26th. They noted that the move was a valuation call. Zacks Investment Research raised shares of LabCorp from a “hold” rating to a “buy” rating and set a $190.00 target price on the stock in a research note on Friday, February 9th. Jefferies Group reaffirmed a “hold” rating and issued a $176.00 target price on shares of LabCorp in a research note on Tuesday, March 6th. ValuEngine raised shares of LabCorp from a “hold” rating to a “buy” rating in a research note on Friday, February 2nd. Finally, Morgan Stanley lifted their target price on shares of LabCorp from $182.00 to $192.00 and gave the stock an “overweight” rating in a research note on Wednesday, February 28th. Five research analysts have rated the stock with a hold rating, twelve have given a buy rating and two have assigned a strong buy rating to the stock. LabCorp has an average rating of “Buy” and an average target price of $191.06.

- [By Max Byerly]

MUFG Americas Holdings Corp trimmed its stake in LabCorp (NYSE:LH) by 55.0% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 10,683 shares of the medical research company’s stock after selling 13,073 shares during the quarter. MUFG Americas Holdings Corp’s holdings in LabCorp were worth $1,728,000 as of its most recent filing with the Securities & Exchange Commission.

- [By Joseph Griffin]

Here are some of the headlines that may have impacted Accern Sentiment’s rankings:

Get Laboratory Corp. of America alerts: Stock Traders Buy Large Volume of Laboratory Corp. of America Put Options (LH) (americanbankingnews.com) Credit Suisse Group Lowers Laboratory Corp. of America (LH) to Hold (americanbankingnews.com) Laboratory Corp. of America (LH) Set to Announce Quarterly Earnings on Wednesday (americanbankingnews.com) Can LaunchPad Aid LabCorp's (LH) Covance Arm in Q1 Earnings? (finance.yahoo.com) As Laboratory Corp Of America Holdings (LH) Shares Rose, Shareholder Veritas Investment Management Llp … (djzplanet.com)LH has been the subject of several research analyst reports. Craig Hallum restated a “buy” rating and set a $204.00 price target (up from $180.00) on shares of Laboratory Corp. of America in a research note on Wednesday, February 7th. Morgan Stanley upped their target price on Laboratory Corp. of America from $182.00 to $192.00 and gave the stock an “overweight” rating in a research report on Wednesday, February 28th. Zacks Investment Research downgraded Laboratory Corp. of America from a “hold” rating to a “sell” rating in a research report on Wednesday, January 3rd. Mizuho set a $178.00 target price on Laboratory Corp. of America and gave the stock a “hold” rating in a research report on Wednesday, January 24th. Finally, Robert W. Baird set a $183.00 target price on Laboratory Corp. of America and gave the stock a “hold” rating in a research report on Thursday, February 8th. Seven investment analysts have rated the stock with a hold rating, ten have assigned a buy rating and two have assigned a strong buy rating to the company. The company presently has an average rating of “Buy” and a consensus price target of $189.19.

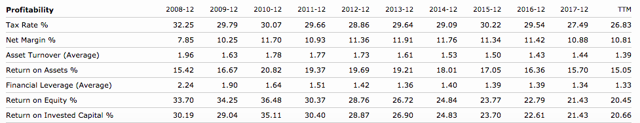

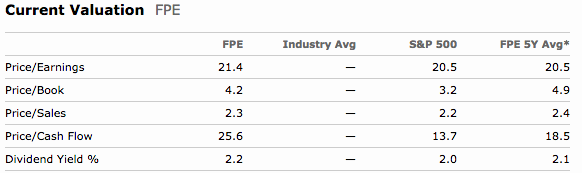

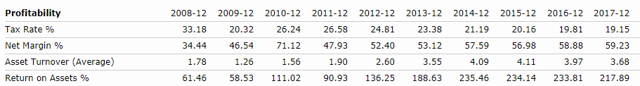

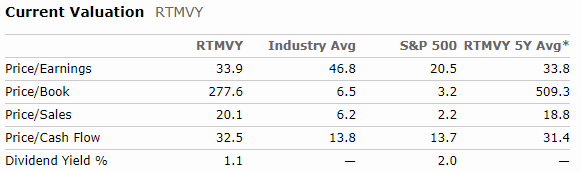

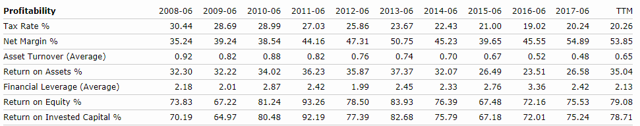

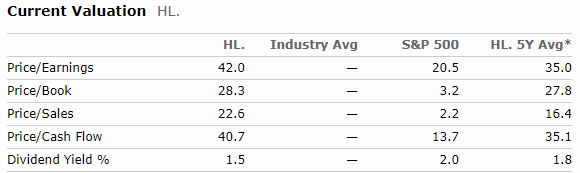

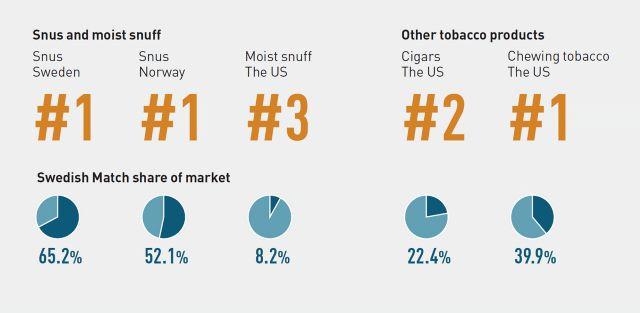

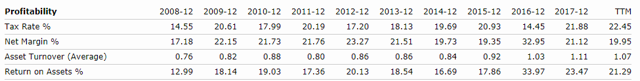

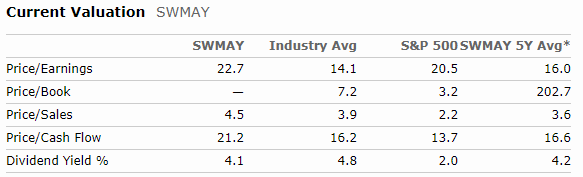

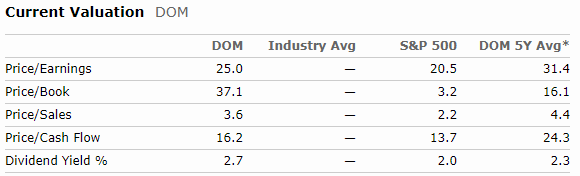

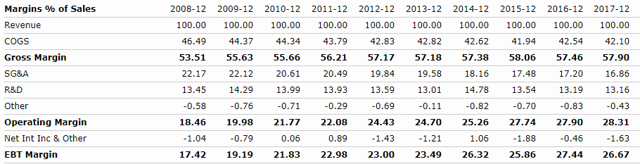

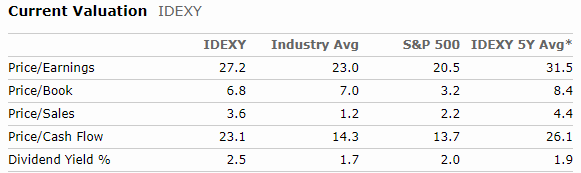

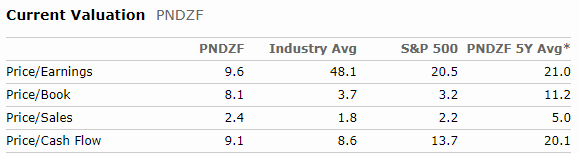

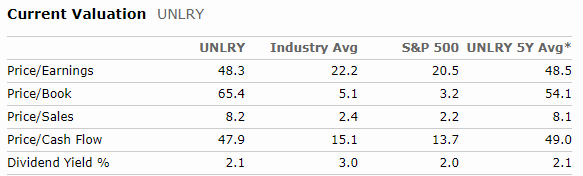

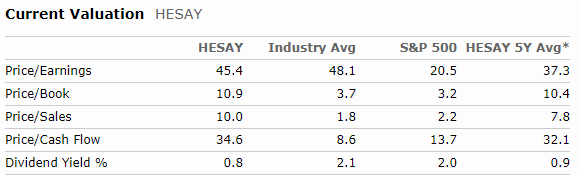

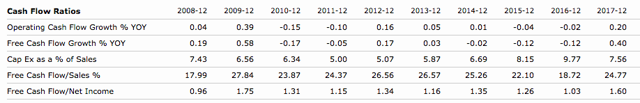

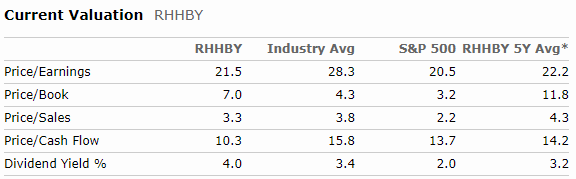

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018. Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.

Source: Morningstar; data as of 6/21/2018.